Student Debt Relief: What It Is and What It Means for Current Students

October 19, 2022

Student loan debt is a common occurrence for those in higher education. College tuition rates are increasingly rising, and many families cannot afford to pay for their children’s education. As a result, thousands of students take out loans each year to pay for rising tuition and other miscellaneous costs associated with attending college. According to Forbes.com, “there is currently $1.75 trillion in student loan debt.” This astronomical amount of debt is owed by around 43 million Americans and includes private as well as federal loans.

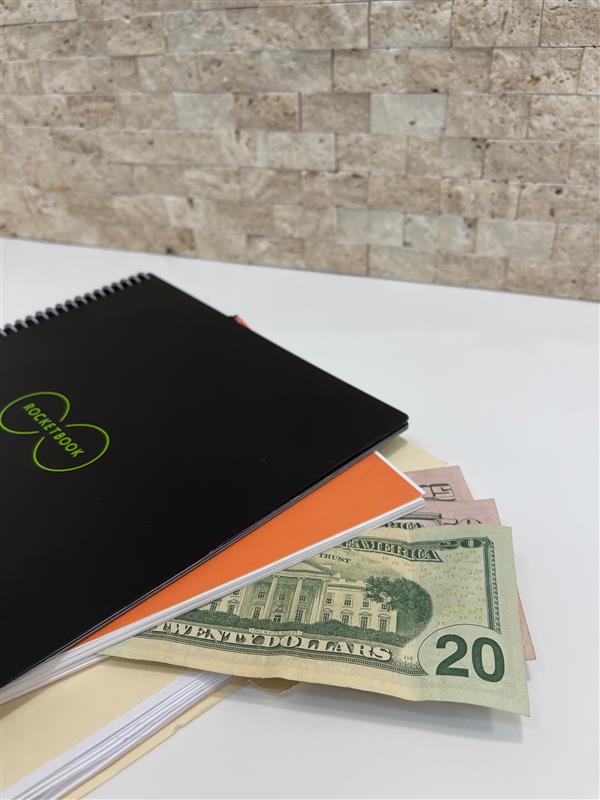

The nature of this debt has led many to define it as a crisis that is causing great financial strain for millions of Americans. Considering the increasing concern about this issue, the Biden-Harris Administration announced a plan to help combat the negative effects of student loan debt. According to the official Federal Student Aid website, “this plan includes a one-time debt forgiveness initiative that will provide up to $20,000 in relief for individual borrowers.” The website outlines the criteria for receiving relief, stating that the borrower must have an annual income below $125,000, or if the borrower is married, the couple’s combined annual income can be no greater than $250,000. If the borrower is listed as a dependent, the income requirement is based on parent income. If a borrower is eligible based on their income and they have received at least one Pell Grant, they will receive $20,000 in debt forgiveness. If a borrower has never received a Pell Grant, they are still eligible for $10,000 in relief provided they meet the income requirement.

Several types of student loan debt are eligible for relief, including undergraduate and graduate direct loans. It is important to note that only loans that are outstanding as of June 30, 2022 are eligible for relief. This means that if a borrower has taken out loans for the current fall semester, those loans are not eligible for relief. It is also significant that borrowers do not need to be currently repaying their loans to be eligible, meaning that current students are still able to receive relief from any qualifying outstanding loans. To receive the relief, most borrowers will need to apply and submit their income data for review. The application for student loan debt is set to be available on the Federal Student Aid website sometime this October. Additionally, borrowers can opt out of the relief plan should they desire to do so.

What does this information mean for current students? The student loan relief program could potentially save current students several thousand dollars. Any student that is eligible based on the previously mentioned criteria can apply for and possibly receive relief for any currently owed student loan debts. While borrowers may be eligible for up to $20,000 in relief, it is important to note that the amount of relief received will not exceed the amount of debt owed. In other words, no excess funds beyond what is owed will be dispersed. The debt relief plan likely sounds like good news to borrowers, but it is currently surrounded by controversy with many questioning its legitimacy and fairness. Some students who have recently paid their student loans, along with those who never took them out, opting instead to pay by working or other means, are questioning the fairness of the relief plan. Others are worried about rising taxes as a result of the relief as there are currently no specifics on how the outstanding debt will be paid. The specific details of the plan are likewise still unclear as tax implications and other legal matters continue to arise.

Gabrielle Bossart is a Dakota Student General Reporter. She can be reached at [email protected].