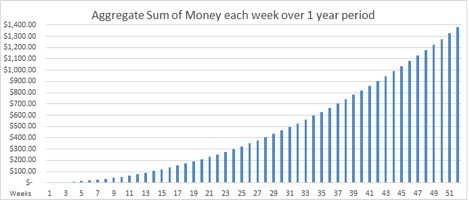

Saving an extra dollar each week adds up

The graph shows the total amount saved each week over a one year period. Graph by Zach Flaten and Abdulelah Darandary/ The Dakota Student

Students suffer from two costs that are associated with attending college: A direct cost such as tuition fees, book costs and indirect costs. These indirect costs, also known as opportunity costs, are the result of attending college and forgoing any income the student could have earned. The assumption is that students are at least capable of being a full-time employee, given a four to five-year bachelor’s degree quest.

As an outcome, students face monetary hardship and worries. Students are limited when it comes to their spending capabilities. Saving money can sometimes become a hindrance with all the expenses and hype that comes with attending college. Groceries, rent, gas, leisure activities and other expenses drain our checking accounts.

A savings plan schedule we found around the internet is very manageable considering the mental burden and the commitment that comes with saving.

The plan is quite simple. There are 52 weeks in a year. Let’s start by saying you were able to save “x” amount dollars corresponding numerically with the number of weeks in a year. For example, in the first week of the year you save $1, in the second week you save $2 and so on. By doing this, you will be able to save $1,378 a year.

If the student is able to save that amount or more, they could even utilize higher earnings than a savings account, such as an individual retirement account (IRA) if possible, or a certificate of deposit (CD). Once interest rates start to rise, the savings accounts’ rate of return will likely shoot up shortly thereafter.

Another savings plan would be to start saving on April 15 (considered National Tax Day), when federal income taxes must be filed with the IRS. If one were to start saving on that week, then there are thirty-six weeks left in the year. If you save 1 dollar for every week that is left in the year, your savings per week will get progressively larger.

However, savings plans are not suited for everyone. Following this plan, the money put away each week will get to over $50 a week, which may be money that a student needs for immediate living expenses.

Nonetheless, it’s important to start one because if you are able to accomplish it now, you would likely be able to save at any point again in your life with much ease.

You can either follow the plan given or create your own, but the most important thing is to begin your saving habits early so they will follow you throughout the rest of your life.

Zach Flaten and Abduelelah Darandary are staff writers for The Dakota Student. They can be reached at [email protected] and [email protected]